2026 is destined to be a pivotal year for Ethereum's Mass Adoption.

With the finalization of multiple underlying upgrades in 2025 and the establishment and advancement of the Interop roadmap, the Ethereum ecosystem is gradually entering the "Great Era of Interoperability." Against this backdrop, EIL (Ethereum Interoperability Layer) is stepping into the spotlight from behind the scenes (Further reading: "Ethereum's Interop Roadmap: Unlocking the 'Last Mile' of Mass Adoption").

If early technical discussions were still at the "proof-of-concept" stage, EIL has undoubtedly now entered the deep waters of standard implementation and engineering. This has sparked a series of major community debates. For instance, when pursuing a Web2-smooth cross-chain experience, are we quietly altering the long-held trust boundaries of Ethereum?

Objectively speaking, when any technological vision moves towards engineering implementation, trade-offs between efficiency and security are inevitable. This article also attempts to move beyond technical slogans and, by examining the specific design details of EIL, deconstruct its real trade-offs between efficiency, standards, and security assumptions.

I. What Exactly is EIL 'Sewing' Together?

First, we need to clarify the essence of EIL once again—it is not a new chain, nor a new consensus layer, but rather a set of interoperability communication frameworks and standard protocol collections.

In short, the core logic of EIL lies in standardizing the "state proofs" and "message passing" of different L2s without rewriting Ethereum's underlying security model, enabling different L2s to possess composability and interaction capabilities akin to a single chain without changing their own security assumptions (Further reading: "The End of Ethereum Islands: How EIL Reconstructs Fragmented L2s into a 'Supercomputer'?").

As is well known, in the current Ethereum ecosystem, each L2 is an isolated island. For example, your account (EOA) on Optimism and your account on Arbitrum, while having the same address, have completely isolated states:

- Signature Isolation: Your signature on Chain A cannot be directly verified by Chain B;

- Asset Isolation: Your assets on Chain A are also invisible to Chain B;

- Interaction Barriers: Cross-chain operations require repeated authorizations, gas swaps, waiting for settlement, etc.;

EIL, combining the capabilities of "Account Abstraction (ERC-4337)" and a "trust-minimized message layer," constructs a unified execution environment at the account layer + message layer, attempting to eliminate these artificial divisions:

The author previously gave an intuitive example: cross-chain interactions used to be like traveling abroad—you needed to exchange currency (cross-chain assets), obtain a visa (re-authorize), and follow local traffic rules (purchase target chain Gas). Entering the EIL era, cross-chain interactions are more like using a Visa card globally:

No matter which country you are in, just swipe your card once (sign), and the underlying banking network (EIL) automatically handles exchange rates, settlement, and verification—you don't perceive the existence of national borders.

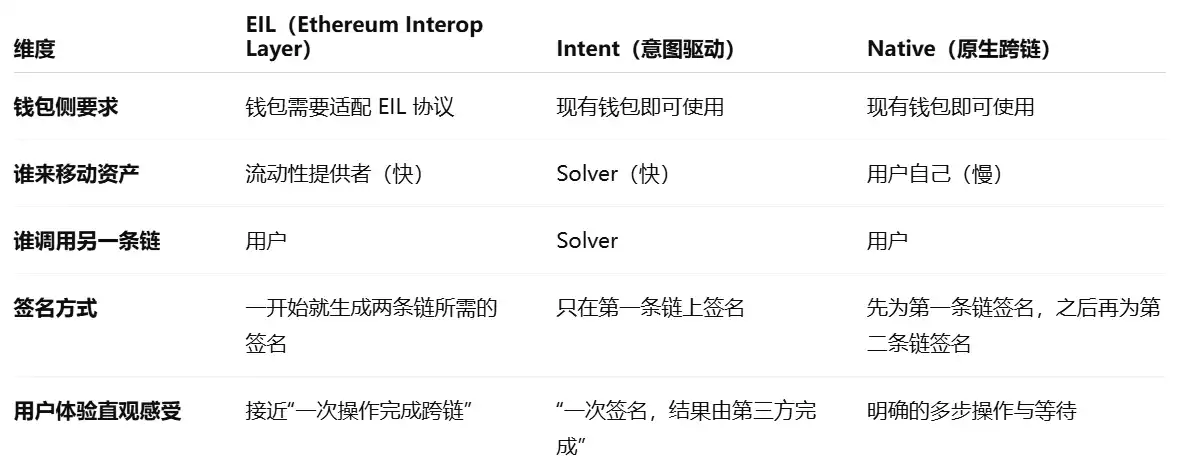

Compared to traditional cross-chain bridges, Relayers, and Intent/Solver models, the advantages of this design are also intuitive—the Native route is the safest, most transparent, but slow and experience-fragmented; the Intent route offers the best experience but introduces Solver trust and game theory; EIL attempts to push the experience closer to Intent without introducing a Solver, but requires deep integration with wallets and protocol layers.

Source: Based on @MarcinM02, self-generated image

The EIL proposal put forward by the Ethereum Foundation's Account Abstraction team paints such a future: users only need to sign once to complete a cross-chain transaction, without relying on centralized relays or adding new trust assumptions, and can initiate transactions directly from their wallet for seamless settlement across different L2s.

II. EIL's Engineering Path: Account Abstraction + Trust-Minimized Message Layer

Of course, this also raises a more practical question: whether the implementation details and ecosystem adaptation of EIL can achieve "theory equals practice" remains an open proposition.

We can break down EIL's engineering implementation path. As mentioned above, it does not attempt to introduce a new inter-chain consensus but is built upon two existing building blocks: ERC-4337 Account Abstraction (AA) + a trust-minimized cross-chain message and liquidity mechanism.

First is Account Abstraction based on ERC-4337. It decouples the account and the private key, allowing a user account to become a smart contract account with customizable validation logic and cross-chain execution logic, no longer limited to the traditional EOA key-pair model.

The significance of this for EIL is that cross-chain operations do not need to rely on external executors (Solvers) to act on your behalf. Instead, they can be expressed at the account layer as a standardized User Operation object (UserOp), constructed and managed uniformly by the wallet.

These functions were previously impossible with EOA itself and required complex external contract wrappers. Account Abstraction based on ERC-4337 allows user accounts to evolve from a rigid "key pair" into programmable code. More bluntly, users only need one signature (UserOp) to express cross-chain intent (Further reading: "From EOA to Account Abstraction: Will Web3's Next Leap Happen in the 'Account System'?"):

Account contracts can embed more complex validation/execution rules; one signature can trigger a series of cross-chain instructions. Combined with mechanisms like Paymaster, it can even achieve Gas abstraction—for example, paying for target chain fees using source chain assets, eliminating the awkwardness of having to buy a few dollars of native Gas tokens before crossing chains.

This is why the EIL narrative is often tied to wallet experience, as what it truly aims to change is the entry point through which users interact with the multi-chain world.

The second is the trust-minimized message passing mechanism—XLP (Cross-chain Liquidity Provider), which solves the efficiency problem of cross-chain message passing.

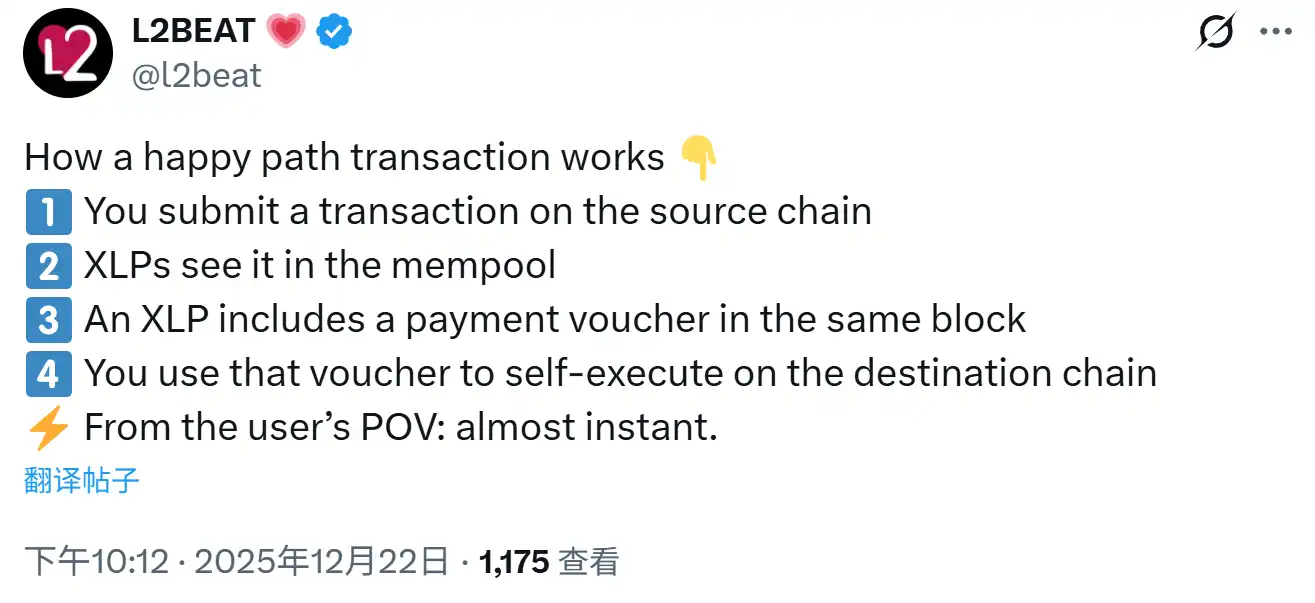

Because traditional cross-chain interactions rely on relays or centralized bridges, EIL introduces XLP. On this basis, an ideal path that is theoretically efficient and sacrifices as little security as possible can be built:

- The user submits a cross-chain transaction on the source chain;

- XLP observes this intent in the mempool and advances funds/Gas on the target chain, providing a "Payment Voucher";

- The user utilizes the voucher to complete self-execution on the target chain;

The actual user experience is near-instantaneous settlement, without waiting for the slow settlement of the official bridge.

However, you might spot a problem: what if the XLP takes the money but doesn't deliver? The ingenious design of EIL lies in the fact that if an XLP defaults, the user can submit proof on Ethereum L1 to trigger permissionless slashing of its staked assets.

The official bridge is only used for settlement and recourse in case of bad debt. This means the system runs extremely fast under normal conditions; in extreme cases, security is still backed by Ethereum L1.

This structure means moving the slow and expensive security mechanism out of the default path, instead concentrating the trust pressure on failure handling.

Of course, this is also one of the sources of controversy: when security relies more on the "executability of the failure path" and the "effectiveness of economic penalties," is EIL truly adding no new trust assumptions? Or is it merely shifting trust from explicit relays to a more hidden, more engineered set of conditions?

This leads to the more critical discussion below—while it looks elegant in theory, what potential centralization and economic frictions might it face in the real-world ecosystem, and why does the community remain cautious about it?

III. Between Vision and Engineering: Is EIL Truly 'Minimizing Trust'?

By now, EIL's ambition is clear. Its design strives to avoid explicit relay trust and attempts to converge cross-chain interactions into one signature and one user operation at the wallet layer.

The problem is—trust doesn't just disappear; it merely migrates.

This is why platforms like L2BEAT, which have long focused on L2 risk boundaries, remain particularly cautious about the engineering implementation of EIL. After all, once an interoperability layer becomes the universal default path, any hidden assumptions, incentive failures, or governance single points of failure could amplify into systemic risks.

Specifically, EIL's efficiency comes from two points: first, AA packages actions into one signature; second, XLP's advance payment allows users to bypass waiting. The former is more straightforward, an efficiency gain from embedded AA. But the latter's advance payment means that some security no longer comes from immediately verifiable finality, but from "economic guarantees that can be pursued and penalized."

This undoubtedly pushes the risk exposure towards several more engineering-oriented questions:

- Under real market fluctuations, how are the XLP's default probability, capital cost, and risk hedging priced?

- Is "slashing" timely and executable enough to cover losses in extreme scenarios?

- When amounts become larger and paths more complex (multi-hop/multi-chain), do failure scenarios become exponentially more difficult?

Ultimately, the trust foundation here is no longer mathematical proof but the validator's staked collateral. If the cost of attack is lower than the potential profit, the system still faces rollback risks.

Furthermore, objectively speaking, EIL attempts to solve liquidity fragmentation through technical means, but liquidity itself is market behavior. If significant cost and trust disparities still exist between chains, a mere communication standard (EIL) cannot make liquidity truly flow. After all, a pure communication protocol standard cannot solve the economic essence of "liquidity unwillingness to flow."

Extending this thought further, without accompanying economic incentive design, EIL might face the dilemma of having standardized pipelines but lacking executors because it's unprofitable.

However, overall, EIL is one of the most important infrastructure concepts proposed by the Ethereum community to address fragmented L2 experiences. It attempts to simplify UX while maintaining Ethereum's core values (self-custody, censorship resistance, disintermediation), which is commendable in itself (Further reading: "Seeing Through the Noise of Ethereum 'Degeneration': Why is 'Ethereum Values' the Widest Moat?").

For ordinary users, there's no need to hastily praise or否定 EIL, but rather to understand its trade-offs and boundary assumptions in protocol design.

After all, for the current Ethereum, EIL is not a simple upgrade to existing cross-chain pain points, but a technical and value attempt that deeply integrates experience, economy, and security trust boundaries. It has the potential to push Ethereum towards truly seamless interoperability, but it might also expose new boundary effects and necessary compromises during implementation.

In Conclusion

In 2026, EIL is not a plug-and-play ultimate answer, but more like a systematic test of trust boundaries, engineering feasibility, and the limits of user experience.

If it succeeds, Ethereum's L2 world will truly look like one chain; if it is less successful, it will undoubtedly leave clear lessons for the next generation of interoperability design.

Before 2026, everything is still an experiment.

And this, perhaps, is Ethereum's most real and most respectable aspect.